First ever, practical software for risk analysis of hedge funds for iPad. The application is published by Risk-AI, an award winning hedge fund risk software firm.

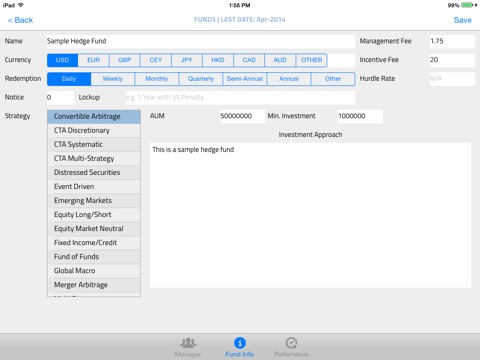

The application provides users with a rich set of functionality previously available only on Desktop or Web-Based platforms.

The application contains tools for performing various risk analysis, raging from simple statistical analysis to multi-factor scenario analysis, style analysis, and others.

The App is available free of charge to all users. However, certain premium features require MONTHLY subscriptions.

Premium Features

1. Export of custom hedge fund reports to PDF for email distribution or marketing purposes. Priced at $9.99 per month.

2. Ability to set up unlimited number of funds on the device. Free version allows up to 5 funds. Priced at $9.99 per month.

3. Access to Risk-AI web portal. Includes unlimited access to all features of the App. Priced at $499 per month.

4. Other features to be developed.

Please note:

All subscription automatically renew on a monthly basis. Your account will be charged for renewal within 24-hours prior to the end of the current period at a price mentioned above.

Subscriptions may be managed by the user and auto-renewal may be turned off by going to the iTunes & App Store settings on your device.

No cancellation of the current subscription is allowed during active subscription period.

BarclayHedge, EurekaHedge and HFR database subscribers can access fund level data available with their hedge fund data license (access needs to be verified by Risk-AI).

While the app’s main focus is hedge fund analysis, all of the tools within the app may also be used for analysis of mutual funds and other managed investments.

Risk-AI Fusion provides detailed help screens explaining main statistical terms and models used in the app. The App can be used by professional hedge fund investors, research analysts, hedge fund marketers, private investors and finance students interested in learning risk analysis.